How risk transfer helps businesses thrive and innovate in a complex world

Every business faces risks, whether it’s from natural disasters, cyberattacks, lawsuits, or market fluctuations. These risks can have devastating consequences for the business owners, their employees, their customers, and their communities. That’s why insurance is essential for every industry, as it provides a way to transfer some of the risks to a third party that share in the risk and minimize financial disruption.

Insurance is not just a cost of doing business, it’s an investment in the future. By paying a premium to an insurer, a business can protect itself from unexpected losses, reduce its uncertainty, and free up its capital for other purposes. Insurance also enables businesses to access new markets, adopt new technologies, and pursue new opportunities, without fear of losing everything. In this way, insurance supports innovation and entrepreneurship, which are the engines of economic growth.

Insurance finds its origins in ancient Chinese culture dating back to 4000-3000 BCE. Of course, it looked a little different than it does now, but the concept is virtually the same: protection of goods and assets. There are accounts of insurance in many ancient civilizations, but the modern insurance model began in the late 1680s. At Lloyd’s Coffee House in London, business leaders would gather to share information about shipping. They would literally write their names under the details of the ship’s manifest to indicate their participation in the event that a ship sunk or lost cargo, hence the beginning of the term underwriter.

In the United States, the first known automobile policy was underwritten by Travelers in 1897 and provided $1000 of coverage for $7.50 in premium. In 2024 that would barely cover the cost of a cup of coffee at Lloyd’s Coffee House (if it existed today). Insurance allowed the automobile industry to make vehicles that moved faster. Without insurance, we would still be travelling at 5 miles per hour. While the industry has advanced in many ways, some principles remain very much the same as you can see in a few examples.

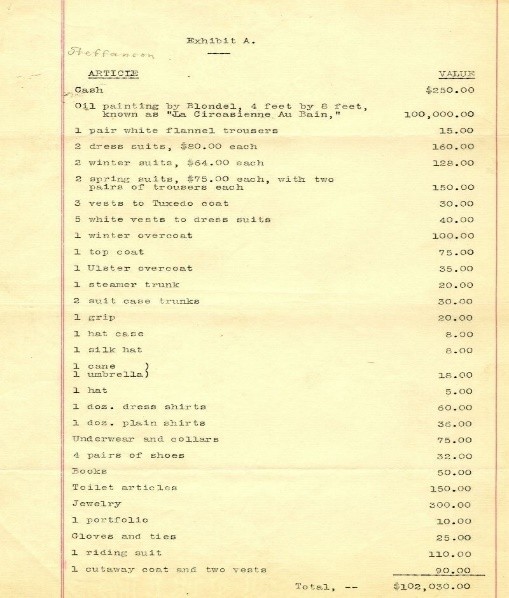

When the Titanic sunk in 1912, beyond the insurance for the vessel, many passengers filed claims for personal property. Mauritz Hakan Bjornstrom-Steffansson filed this claim which included, among other things, $100,000 for the loss of a large oil painting by a French painter. He also included a claim for six dress suits and four pairs of shoes. It is unlikely that many people total travel with six dress suits, however, our supply chain and ability to ship product around the world would be impossible without insurance.

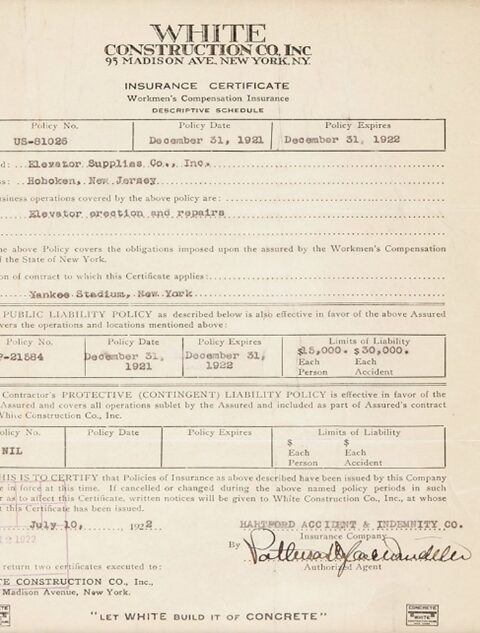

The original Yankee Stadium was built in 1921. White Construction, just like many contractors today, was required to provide a certificate of insurance that proved that they had coverage. That certificate looked very much like it does today and that insurance was necessary for athletic teams to flourish and generate income.

In 1960, Audrey Hepburn had a policy specifically for her back in the event of an injury that impacted her career. She fell off a horse while filming The Unforgiven and collected $240,000. Other historical celebrity insurance was also common. Charlie Chaplin’s original costume was insured for 10,000 pounds in the 1920s and his feet were individually insured for $50,000 in the event that he lost one. Would the entertainment industry be able to produce blockbuster movies, with dangerous stunts and special effects without the benefit of insurance?

Celebrity insurance remains common today including policies for voices, legs, and hands. Keith Richards has famously insured his hands for $1.6M and Mariah Carey insured her vocal cords for $35M. That begs the question. How can an underwriter put a price on Taylor Swift’s voice, legs, and hands? By the way, did you ever wonder who pays when a golfer wins a Hole in One contest?

So, the next time that insurance premium feels a bit high, remember that without the policy or the industry, all businesses and industries would be forced to allocate significantly more capital for risk management, which would hinder individual business growth and domestic and global economic activity.